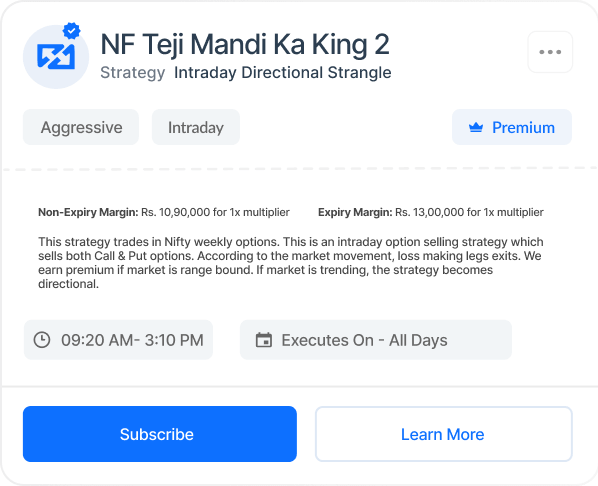

Factor: NF Teji Mandi

Peak Margin: ₹ 10,90,000 for 1X

Multiplier Range: 1X to 45X

Start Time: 09:20 AM

End Time: 03:10 PM

Execution Days: All

Preferable Days: NA

Favourable Conditions:

- Fall in volatility (or VIX)

- Directional move either upwards or downwards

- Weekly expiry days are best suited

- Recommended VIX : 15 to 30

Risk Factors:

- Rise in volatility (or VIX)

- No decay in premiums

- When market trades in both directions