The Relative Strength Index (RSI) is a popular momentum oscillator that has gained widespread recognition among traders and investors alike. It is a versatile technical indicator that measures the speed and change of price movements, helping traders identify overbought or oversold conditions in the market. In the realm of algorithmic trading, on platforms like uTrade Algos, the RSI indicator has emerged as a must-have tool for several compelling reasons. In this blog post, we will explore the key features and benefits of integrating the RSI indicator into algorithmic trading programs.

What is the RSI Indicator?

The RSI indicator is a momentum oscillator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in a particular asset. It ranges from 0 to 100 and is typically plotted on a graph alongside price movements. A high RSI value indicates that an asset may be overbought, while a low RSI value suggests that it may be oversold.

Key Features of the RSI Indicator

- Momentum Measurement: The RSI indicator measures the speed and change of price movements, providing valuable insights into the strength of market trends.

- Overbought/Oversold Conditions: The RSI helps traders identify potential overbought or oversold conditions, signalling potential trend reversals or corrections in the market.

- Divergence Analysis: The RSI can be used to analyse divergence between price and momentum, providing early warnings of potential trend changes or continuations.

Benefits of Incorporating the RSI Indicator into Algo Trading Platforms

Enhanced Trading Strategies

- Dynamic Entry and Exit Points: By incorporating the RSI indicator into algorithmic trading programs, traders can develop dynamic trading strategies that utilise RSI-based signals for precise entry and exit points.

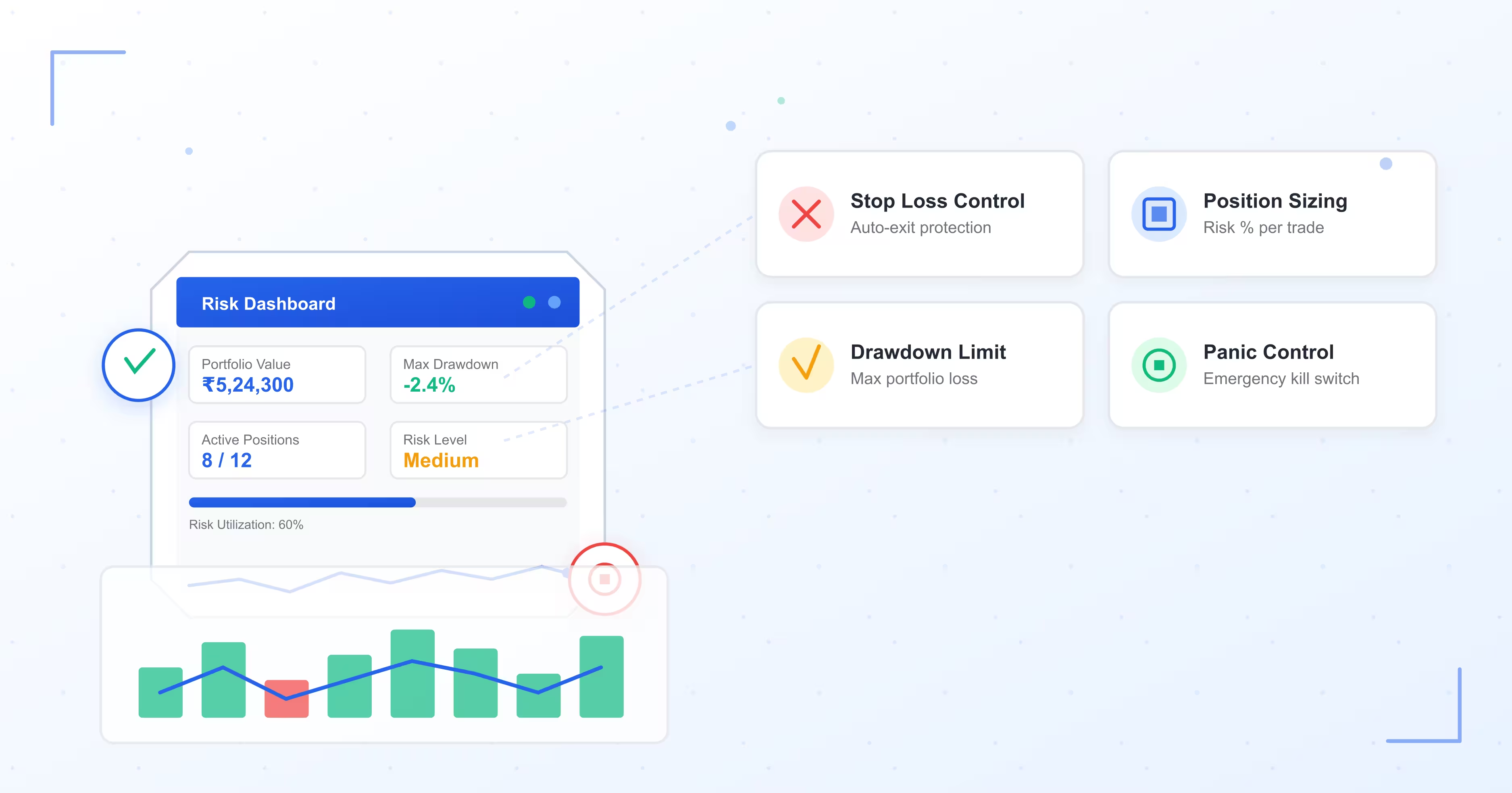

- Risk Management: The RSI indicator can be used to set predefined risk parameters, such as stop-loss, thus helping traders manage risk effectively and protect capital.

Real-Time Market Analysis and Decision Making

- Real-time Monitoring: Algorithmic trading software, like uTrade Algos, can leverage the RSI indicator for real-time market monitoring, allowing traders to stay updated on market conditions and make informed trading decisions.

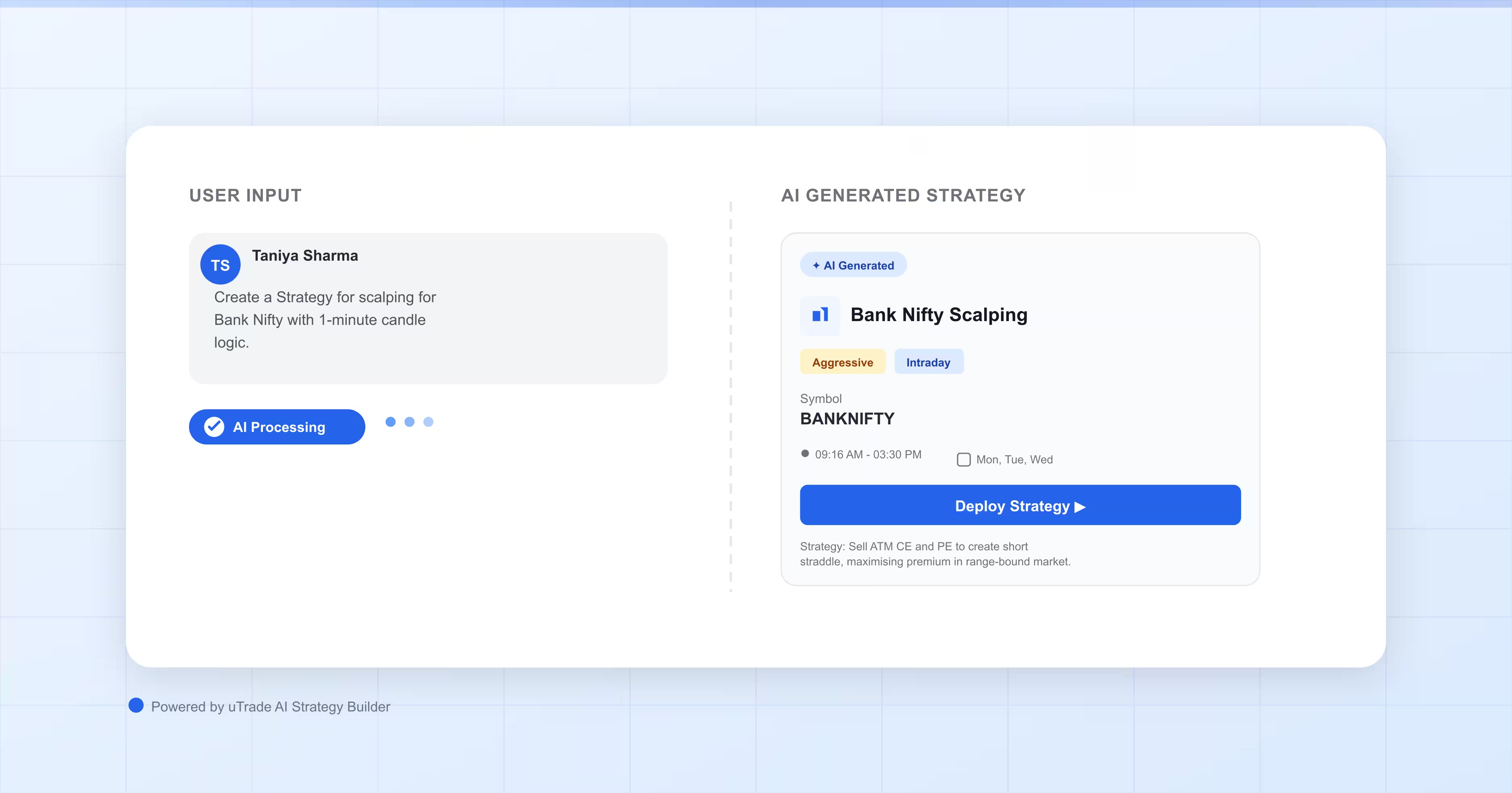

- Automated Trading: The RSI indicator can be integrated into automated trading algorithms, enabling algo trading platforms to execute trades automatically based on RSI-based signals and predefined trading rules.

Versatility and Adaptability

- Multi-Asset Support: The RSI indicator is versatile and can be applied to various asset classes, including stocks, forex, commodities, and cryptocurrencies, making it a valuable tool for diversifying trading portfolios.

- Customisation and Flexibility: Algo trading platforms can offer customisation options that allow traders to tailor the RSI indicator's parameters and settings to suit their trading style, risk tolerance, and investment goals.

What to Be Cautious About When Using the RSI Indicator

Over-Reliance on RSI Signals

One of the most common mistakes traders make when using the RSI indicator is relying too heavily on its signals. While the RSI can provide valuable insights into market conditions, it should not be used as the sole basis for making trading decisions. Traders should consider using the RSI in conjunction with other technical indicators, chart patterns, and fundamental analysis to confirm signals and validate trading strategies.

False Signals and Whipsaws

The RSI indicator is not infallible and can generate false signals, especially during volatile market conditions. Traders should be cautious of whipsaws, where the RSI moves above or below the overbought or oversold levels but fails to sustain the momentum, resulting in potential losses. To mitigate the risk of false signals, traders should use additional filters and confirmatory signals to validate RSI-based trading signals before entering trades.

Parameter Sensitivity

The effectiveness of the RSI indicator can vary depending on the chosen parameters, such as the period length and overbought/oversold levels. Traders should be cautious when selecting RSI parameters and avoid using default settings without customisation. It is essential to optimise and adjust the RSI parameters based on the specific market conditions, asset class, and trading strategy to achieve more accurate and reliable results.

Ignoring Market Context

Traders should be careful not to ignore the broader market context and rely solely on the RSI indicator when making trading decisions. Factors such as economic indicators, news events, and overall market sentiment can influence price movements and override RSI signals. Therefore, traders should conduct comprehensive market analysis and consider the bigger picture before acting on RSI-based signals.In conclusion, the RSI indicator, for algorithmic trading in India and elsewhere, is a must-have tool for algorithmic trading software like uTrade Algos due to its versatility, adaptability, and ability to enhance trading strategies, risk management, and real-time market analysis. By integrating the RSI indicator into algo trading platforms, traders can leverage its unique features and benefits to optimise trading performance and achieve long-term trading success in today's dynamic and competitive financial markets.