Defining Algo Trading

Algo trading is a trading strategy that uses computer algorithms to automate the process of buying and selling financial securities in the financial markets.

- It involves using advanced mathematical models, statistical analysis, and predefined rules to execute trades at high speeds and with precision.

- The algorithms analyse market data, such as price movements, volume, and other relevant indicators, to identify trading opportunities and make trade decisions without human intervention.

- It aims to capitalise on minor price discrepancies, exploit market inefficiencies, and execute trades more efficiently and objectively than traditional manual trading methods.

- It is commonly employed by institutional investors, hedge funds, and proprietary trading firms, but technological advancements have also made algo trading accessible to individual retail traders.

Understanding How Algo Trading Works

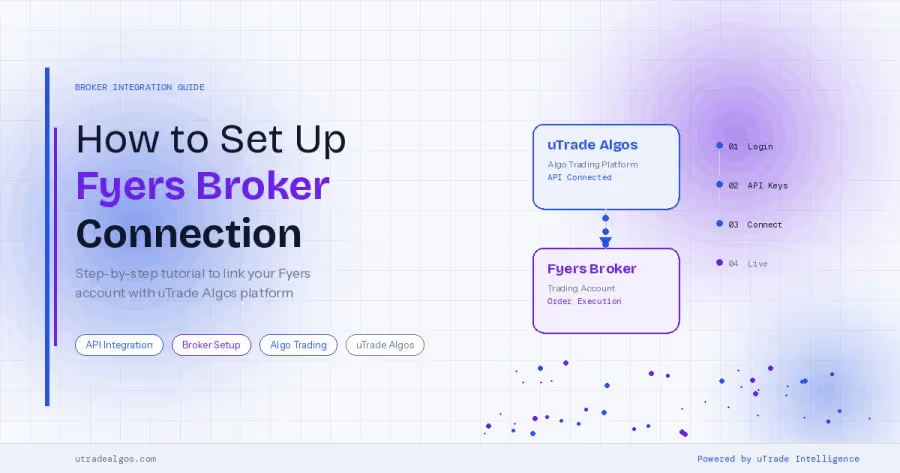

- Algorithm Development: Algo trading, on platforms like uTrade Algos, begins with the creation of trading algorithms, which are sets of rules and instructions written in code. These algorithms can be designed to execute various strategies based on predefined market conditions and data.

- Data Collection and Analysis: Algo traders rely on vast amounts of real-time and historical market data to make informed decisions. They collect and analyse data from various sources, such as price feeds, news articles, and economic indicators.

- Automated Execution: Once the algorithms are developed and data is analysed, algo trading systems automatically execute trades based on the predefined rules. This automated execution eliminates the need for manual intervention and ensures trades are executed at the most opportune moments.

- High-Frequency Trading (HFT): A subset of algo trading is HFT, where algorithms execute trades at extremely high speeds, often within milliseconds. HFT strategies capitalise on tiny price discrepancies and market inefficiencies.

- Risk Management: Algo trading systems incorporate risk management protocols to control exposure and protect against potential losses. These risk management measures help maintain the trader's desired risk-reward profile.

Basic Requirements of Algo Trading

- Decent Understanding of Programming Languages: Algo trading requires traders to have a good grasp of programming languages to program their strategies effectively. Alternatively, they can utilise trading software with similar capabilities to automate calculations.

- Real-time Market Data Access: Algo trading relies on real-time access to market data to make informed decisions and place orders for buying or selling at advantageous points.

- Historical Data Access for Backtesting: Traders need access to historical data to backtest their algorithms, ensuring their stability and effectiveness for high-frequency trading.

- Stable and Efficient Algorithms: Algo trading systems must be stable and efficient, capable of handling high-frequency trading and backtesting seamlessly.

Strategies in Algo Trading

Trend-following

- Trend-following is a popular strategy where algorithms analyse historical price data to identify trends in the market.

- The most common technical indicators used for trend-following are moving averages, such as the 50-day or 200-day moving averages.

- When the short-term moving average crosses above the long-term moving average, it generates a ‘buy’ signal, and when the short-term moving average crosses below the long-term moving average, it generates a ‘sell’ signal.

- This strategy aims to capture profits during sustained price movements in the same direction.

Arbitrage Strategies

- Arbitrage strategies involve exploiting price discrepancies between different assets or markets.

- The algorithm identifies price differences in related assets and executes trades to take advantage of these price inefficiencies.

There are various types of arbitrage strategies, such as:

- Statistical Arbitrage: This strategy uses statistical models to identify mispricings between related securities and executes trades to profit from the convergence of prices.

- Triangular Arbitrage: In the foreign exchange market, this strategy exploits price discrepancies between currency pairs involving three different currencies to generate profits.

- Merger Arbitrage: This strategy takes advantage of price discrepancies in the stock prices of companies involved in mergers or acquisitions.

Mathematical Models

- Algorithmic trading can employ sophisticated mathematical models to generate trading signals.

- The delta-neutral strategy is an example of such an approach. Delta refers to the sensitivity of an option's price to changes in the underlying asset's price. The delta-neutral strategy involves maintaining a portfolio with a delta value close to zero by balancing long and short positions. This way, the strategy is less affected by small price movements in the underlying asset and focuses on other factors such as volatility and time decay.

Volume/time-weighted Average Price (VWAP/TWAP) Strategies

- VWAP and TWAP are commonly used by institutional traders to execute large orders while minimising market impact.

- VWAP represents the average price of a security weighted by its trading volume over a specified period. TWAP, on the other hand, splits the order into smaller chunks and executes them over a predefined time period, distributing the order's impact over time.

- These strategies are effective for trading large volumes without significantly affecting the market price.

It's important to note that when it comes to understanding how algo trading works, it can be said that these strategies can be highly complex and involve a combination of multiple factors, indicators, and risk management techniques. The success of these strategies relies on the quality of data, robustness of the algorithms, and careful risk management practices. Additionally, regulations and market conditions can also impact the effectiveness of algorithmic trading strategies. Traders and institutions using such strategies, hence, must continuously monitor and adjust their strategies to adapt to changing market dynamics.

Benefits of Algo Trading

- Speed and Efficiency: It operates at high speeds, enabling traders to take advantage of market opportunities instantaneously.

- Precision and Consistency: Automated execution ensures trades are executed as per the predefined rules, eliminating human errors and emotions.

- Backtesting: Traders can test their algorithms on historical data to assess their performance before deploying them in real-time trading.

- Order Placement: It involves automatic signals triggered by computer programs for instantaneous order placement at the best possible prices.

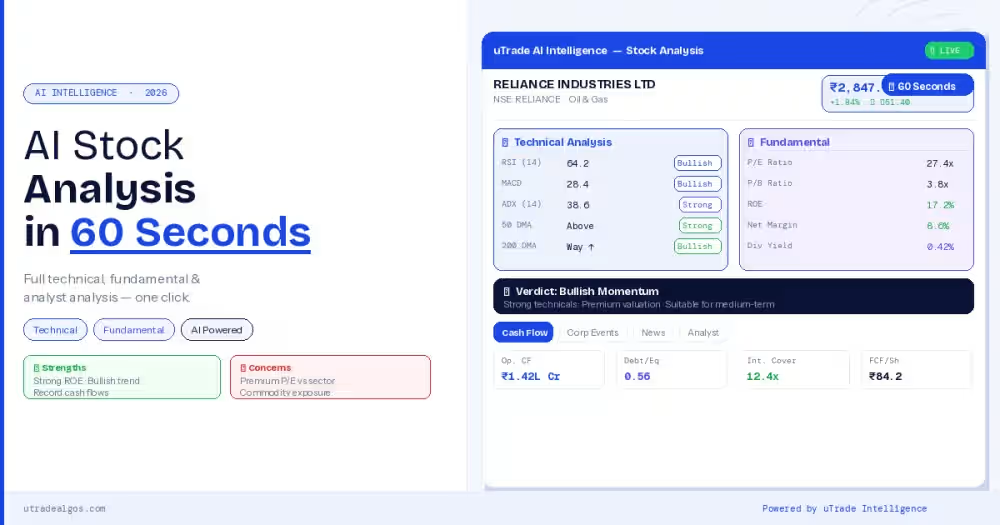

- Lower Transaction Costs: Algorithmic trading on platforms like uTrade Algos incurs significantly lower transaction costs compared to manual trading.

- Simultaneous Market Checks: It can initiate automated checks on several market conditions simultaneously.

- Effective Trade Timing: It excels in its efficacy and perfect trade timings, capturing even slight price changes.

- Arbitrage Opportunities: It allows taking advantage of arbitrage opportunities due to its quick response to price changes.

Challenges of Algo Trading

Bug or Error

- Complex algorithms can lead to wrong decisions or transactions due to coding errors.

- Thorough back-testing before implementation can minimise this risk.

Chain Market Reaction

- Interconnected global markets can trigger chain reactions with delays or disruptions.

- Vigilant monitoring of market conditions is essential.

Market Disbalance

- Not all traders have access to advanced algorithms, leading to market fragmentation.

- Potential liquidity issues may arise.

Lack of Understanding

- Some high-frequency trading platforms lack transparency, hindering accurate prediction of outcomes.

- Insufficient market understanding can lead to inefficient trading and poor returns.

- Traders remain responsible for successful trade execution.

Impact on the Financial Industry

Algorithmic trading has had a significant impact on financial markets, reshaping the way trading is conducted and influencing market dynamics in several ways:

- Increased Liquidity: It has contributed to increased liquidity in the financial markets because it can quickly match buyers and sellers, providing more trading opportunities and reducing bid-ask spreads, making it easier and cheaper for investors to enter and exit positions.

- Reduced Transaction Costs: With automated trading, transaction costs have generally decreased due to improved efficiency and competition among market participants. Lower transaction costs benefit both institutional and retail investors.

- Market Efficiency: It has improved market efficiency by incorporating vast amounts of data and reacting to market movements almost instantaneously. This reduces the time it takes for prices to reflect new information and helps markets become more reflective of fundamentals.

- Price Volatility: The speed and efficiency of it can contribute to short-term price volatility. High-frequency trading algorithms can amplify price movements, leading to rapid price swings in certain market conditions.

- Market Fragmentation: The rise of multiple trading venues and the use of different algorithms has led to market fragmentation. This can result in less transparent markets and complex interactions among different platforms.

- Regulatory Challenges: The proliferation of algorithmic trading has presented regulatory challenges for financial authorities. Regulators need to strike a balance between ensuring market stability and fostering innovation while monitoring potential risks related to it.

- Flash Crashes and Glitches: In rare cases, it has been associated with flash crashes and technical glitches. Errors in algorithms or unforeseen interactions between different algorithms can lead to sudden and significant market disruptions.

- Increased Competition: It has increased competition in the financial markets. Smaller firms and retail traders can compete with larger institutions on a more level playing field as access to advanced trading technology has become more accessible.

- Scalability: It allows for efficient scaling of trading strategies. Strategies that have proven successful can be easily applied to larger trading volumes without compromising performance.

- Behavioural Impact: The presence of it may influence investor behaviour and perceptions of market dynamics. Traders and investors might adjust their strategies based on observed algorithmic activity.

Is Algo Trading Profitable?

Yes, algorithmic trading can be profitable for certain traders. It offers a systematic and disciplined approach to trading, allowing for efficient identification and execution of trades. The lack of emotional bias can lead to more objective decision-making, and the ability to execute trades at optimal prices can enhance profitability.

However, it is not a guaranteed path to profits. Traders should be aware of the risks and uncertainties associated with this form of trading. The development and implementation of algorithmic trading systems can be costly, and ongoing fees for software and data feeds may apply.Like any form of investing, success in it requires thorough research, an understanding of potential risks, and careful risk management. While it can offer advantages, it is crucial for traders to tailor their strategies to their individual goals, skills, and market conditions to achieve profitability.

Can Algo Trading Beat the Market?

Algorithmic trading has the potential to outperform traditional manual trading strategies and, in some cases, beat the market. However, it is essential to understand that it is not a guaranteed way to consistently beat the market. Several factors influence the success of it in outperforming the market:

- Strategy Design: The effectiveness of an algorithmic trading strategy depends on how well it is designed.

- Market Conditions: Its success is heavily influenced by market conditions. Markets can be unpredictable, and even the best algorithmic strategies may encounter challenges during turbulent periods.

- Data Quality and Backtesting: Accurate historical data and comprehensive backtesting are essential for evaluating the performance of an algorithmic strategy. However, historical data may not always reflect future market conditions accurately, and backtesting results should be interpreted with caution.

- Competition and Latency: The effectiveness of high-frequency trading strategies, which aim to capitalise on small price discrepancies, can be influenced by competition and low latency execution. Larger institutions and well-funded market participants may have an advantage in executing high-frequency strategies.

- Risk Management: Successful algorithmic trading involves proper risk management. Overleveraging or inadequate risk controls can lead to significant losses, even with a potentially profitable strategy.

- Regulatory and Market Changes: Changes in regulations or market structure can impact the profitability of certain algorithmic trading strategies.

Algorithmic trading, as we can see from the above discussion, indeed can offer the potential for increased profitability. However, traders must be aware of the risks associated with it. While it can be a powerful tool, it is not a guaranteed path to success, and careful consideration of one's goals and skills is essential for a successful implementation. We have plenty of resources and tools at uTrade Algos if you need more clarification about algorithmic trading. Happy trading!