The algorithms used in algo trading are generally tested logically or historically to determine their effectiveness. Logical testing involves following a set of rules and calculations to determine if a strategy will be profitable. Historical testing involves applying a rule or set of rules over past years to see if they would have made money.

Becoming a successful trader is not only about hard work and discipline but also the ability to predict the market correctly. For this, the correct strategy is needed. Gone are the days when strategies were mapped on pen and paper. With technological advancements, there now exist models that use various parameters to predict whether a strategy will reap profits. This, known as algorithmic trading, has made trading transformative in many ways – right from increasing a trader’s profit opportunities to helping remove the impact of human fallacies.

The Meaning of Algorithm Trading

An algorithm is a process of rules and calculations that need to be followed. This finite sequence of instructions helps to solve certain problems or helps to perform a computation. Algorithms use a set of input(s) to produce the desired output.

Algorithmic trading is also referred to as algo trading and black box trading. It is a trading system that utilizes automated pre-programmed complex mathematical models and formulae to make high-speed decisions and transactions in the financial markets.

These automated trading instructions consider variables like time, price, and volume to make the calculations. It is relatively advantageous over the use of human traders because of its speed and the computational resources of computers that are put to use.

Before putting them to use, the algorithms are generally tested in one of two ways:

- Logically – This means that if I buy shares at $315 and sell at $317, then I will always make money as long as I can get both sides of my trade executed

- Historically – This asks, ‘If I applied my rule(s) over the past xx years, would I have made money?

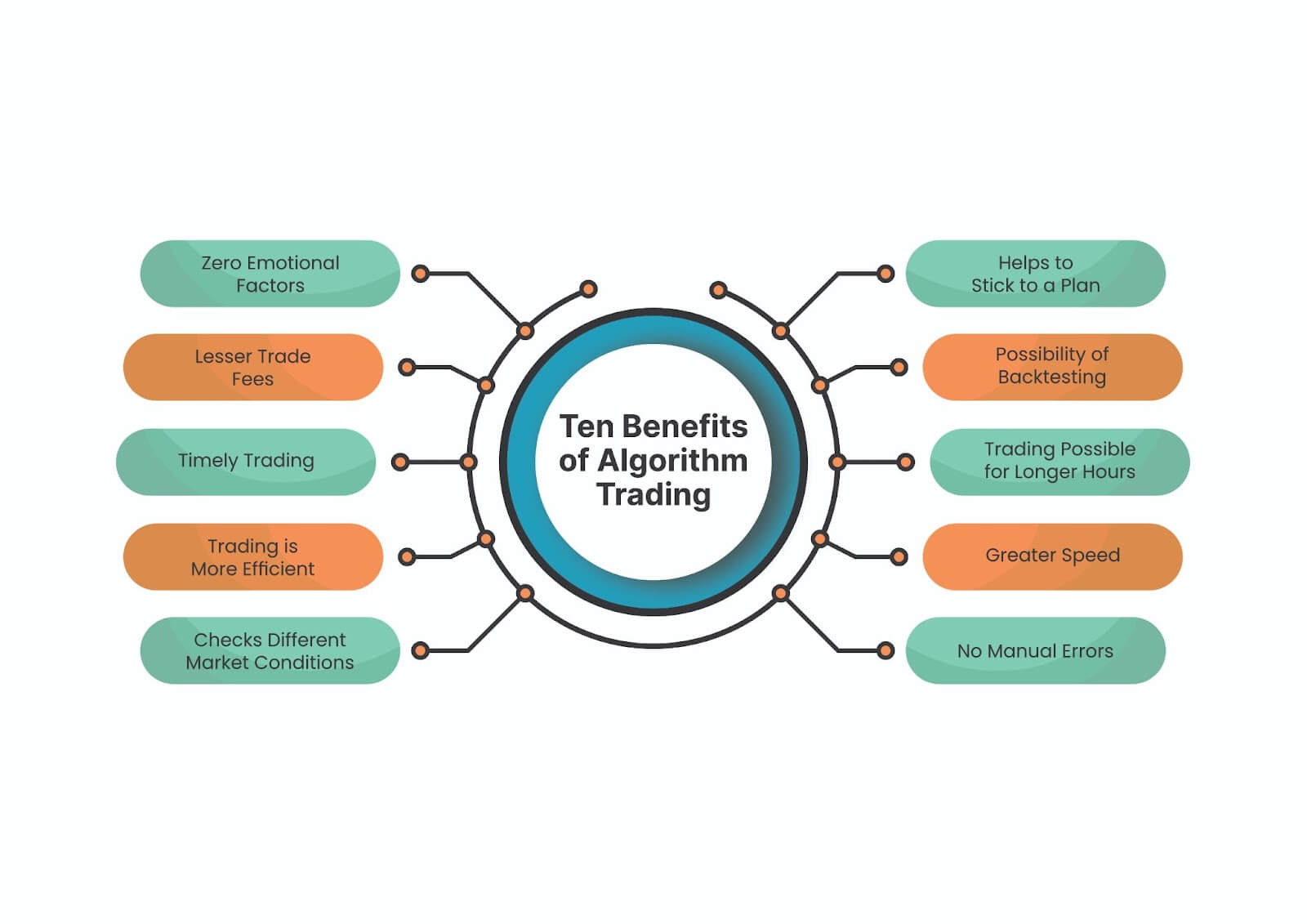

Ten Benefits of Algorithm Trading

Investment banks, pension funds, mutual funds, and hedge funds have begun to use algorithm trading. This is more so for larger trades or those that need a quick reaction time, which is impossible for a human trader to perform. The growth of algorithm trading has been so much that a 2019 research showed that around 92 per cent of trading in the Forex market was being performed via algorithms. The benefits of algorithm trading are many, and here are the top ten.

1. Zero Emotional Factors

When humans carry out trading, there is always an emotional factor involved. The algorithmic trading system strips emotions out of trading. Hence, it can ensure the most efficient execution of a trade.

2. Lesser Trade Fees

When it comes to using humans for trading purposes, a considerable trade fee is involved. However, if one uses algorithmic trading, the trading fees get lowered.

3. Timely Trading

Algorithmic trading combines computer programming and financial markets such that trades get executed at the correct time. Hence, one can place orders instantaneously. This helps earn more profit by running the trades in the market in a timely fashion.

4. Trading is More Efficient

Humans helping in trading brings into play the gut instinct that might only be accurate sometimes. However, when trading is done via the use of pre-tested mathematical models, it becomes more efficient.

Added to this, one does not have to stay glued to the screen when trading it on. This, hence, leaves him with more time to do other work.

5. Checks Different Market Conditions

Since algorithmic trading is based on mathematical models, it is able to auto-check on multiple market conditions. Hence, errors that can be made if humans are employed are avoided in cases of algo trading.

6. Helps to Stick to a Plan

When humans trade, impatience creeps in and the willingness to stick to a plan might falter. However, auto-models of trading will adhere to a plan that is set by an individual.

7. No Manual Errors

When humans carry out trading, there is always the chance of making manual errors. For example, with manual entries, there is the chance of buying the wrong currency pair for the wrong amount. This gets reduced when it becomes automated. Thus, the chance of losses due to errors is also reduced.

8. Possibility of Backtesting

Algo trading can be backtested based on the available historical and real-time data. This helps one to find out if a trading strategy is a viable option or not.

9. Trading Possible for Longer Hours

In Algo trading, one can trade at the markets 24 hours a day. The human just has to pick for how long he wants to trade. This is many times more than what is possible via manual trading.

10. Greater Speed

HFT (High-Frequency Trading), an extension of algorithm trading, is used to place a large number of orders for buying and selling so as to make quick profits from asset mispricing or bid/ask spreads.

Where You Need to be Careful

In a perfect world, we would have nothing to worry about. But just like everything else, algorithm trading has some cons attached to it, which traders must be aware of.

- Humans have brains and can think. In algo trading, everything works based on certain criteria, which might also lead to losses at times.

- Bad programming can lead to heavy losses.

- To formulate a code that can be used, one may need to know coding languages.

- Some nations have regulatory restrictions concerning algo trading.

- Proper infrastructure is needed – like access to a computer and the Internet.

Algorithmic trading might have its disadvantages, but the advantages are manifold – it is a powerful system which can mitigate trade losses. It is not for the faint-hearted though one should know about it thoroughly before using this system. The future of algorithm trading does, indeed, look quite bright.

To Summarise,

- Successful trading comes with hard work and the ability to predict the market correctly

- Algorithmic trading helps – it uses a set of input(s) to produce the desired output

- The advantages of algo trading include greater speed, no manual errors and the possibility of backtesting

- Disadvantages include the inability to think like humans, the need to know coding languages, and the need to have access to a computer and the Internet.

Algorithmic trading might have its disadvantages, but the advantages are manifold – it is a powerful system which can mitigate trade losses. It is not for the faint-hearted though one should know all about it thoroughly before using this system. The future of algorithm trading does, indeed, look quite bright.

Algorithmic trading uses pre-programmed complex mathematical models and formulae to make high-speed decisions and transactions in the financial markets, resulting in more efficient and profitable trading.

Algorithmic trading eliminates the emotional factor from trading, resulting in more efficient execution of trades and reduced trade fees.

Algorithmic trading is more efficient, saves time, and checks multiple market conditions.

Algo trading helps to stick to a trading plan and reduces the chance of making manual errors.

May 1, 2023

May 1, 2023